S 2: Chapter Outline

1.1 What is Corporate Finance?

1.2 Corporate Securities as Contingent Claims on Total Firm Value

1.3 The Corporate Firm

1.4 Goals of the Corporate Firm

1.5 Financial Markets

1.6 Outline of the Text

S 3: What is Corporate

Finance?

Corporate Finance

addresses the following three questions:

1.What long-term investments

should the firm engage in?

2.How can the firm raise the

money for the required investments?

3.How much short-term cash flow

does a company need to pay its bills?

S 4: The Balance-Sheet

Model of the Firm

S 5: The Balance-Sheet Model of the Firm

S 6: The Balance-Sheet Model of the Firm

S 7: The Balance-Sheet Model of the Firm

S 8:Capital Structure

- The value of the firm can be thought of as a pie.

- The goal of the manager is to increase the size of the pie.

- The Capital Structure decision can be viewed as how best to slice up a the pie.

- If how you slice the pie affects the size of the pie, then the capital structure decision matters.

S 9: Hypothetical

Organization Chart

S 10:The Financial Manager

To create value, the

financial manager should:

1.Try to make smart investment decisions.

2.Try to make smart financing decisions.

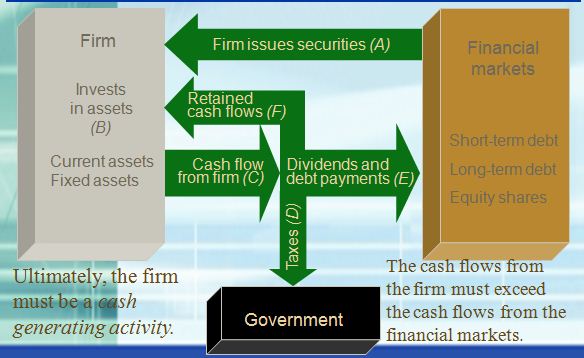

S 11: The Firm and the

Financial Markets

S 12:1.2 Corporate

Securities as Contingent Claims on Total Firm Value

- The basic feature of a debt is that it is a promise by the borrowing firm to repay a fixed dollar amount of by a certain date.

- The shareholder’s claim on firm value is the residual amount that remains after the debtholders are paid.

- If the value of the firm is less than the amount promised to the debtholders, the shareholders get nothing.

S 13: Debt and Equity as

Contingent Claims

S 14:Combined Payoffs to Debt

and Equity

S 15:1.3 The Corporate

Firm

S 16: Forms of Business

Organization

- The Sole Proprietorship

- The Partnership

- General Partnership

- Limited Partnership

- The Corporation

- Advantages and Disadvantages

- Liquidity and Marketability of Ownership

- Control

- Liability

- Continuity of Existence

- Tax Considerations

S 17: A Comparison of

Partnership and Corporations

S 18: 1.4 Goals of the

Corporate Firm

- The traditional answer is that the managers of the corporation are obliged to make efforts to maximize shareholder wealth.

S 19: The Set-of-Contracts

Perspective

- The firm can be viewed as a set of contracts.

- One of these contracts is between shareholders and managers.

- The managers will usually act in the shareholders’ interests.

- The shareholders can devise contracts that align the incentives of the managers with the goals of the shareholders.

- The shareholders can monitor the managers behavior.

- This contracting and monitoring is costly.

S 20: Managerial Goals

- Managerial goals may be different from shareholder goals

- Expensive perquisites

- Survival

- Independence

- Increased growth and size are not necessarily the same thing as increased shareholder wealth.

S 21: Separation of

Ownership and Control

S 22: Do Shareholders

Control Managerial Behavior?

- Shareholders vote for the board of directors, who in turn hire the management team.

- Contracts can be carefully constructed to be incentive compatible.

- There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced.

- If the managers fail to maximize share price, they may be replaced in a hostile takeover.

S 23: 1.5 Financial Markets

- Primary Market

- When a corporation issues securities, cash flows from investors to the firm.

- Usually an underwriter is involved

- Secondary Markets

- Involve the sale of “used” securities from one investor to another.

- Securities may be exchange traded or trade over-the-counter in a dealer market.

S 24:Financial Markets

S 25: Exchange Trading of

Listed Stocks

- Auction markets are different from dealer markets in two ways:

- Trading in a given auction exchange takes place at a single site on the floor of the exchange.

- Transaction prices of shares are communicated almost immediately to the public.

S 26: 1.6 Outline of the

Text

I.Overview

II.Value and Capital Budgeting

III.Risk

IV.Capital Structure and Dividend Policy

V.Long-Term Financing

VI.Options, Futures and Corporate Finance

VII.Financial Planning and Short-Term Finance

VIII.Special Topics

No comments:

Post a Comment